Wang Jianlin’s crisis still seems to be unresolved.

According to the information disclosed by the Tianyancha APP, the joint stock company of Dalian Wanda Commercial Management Group recently added an equity freeze information. It is understood that the amount involved in the equity freeze is as high as 16.205 billion yuan, and the company being executed is Dalian Xindameng Commercial Management Co., Ltd. Through equity penetration, the actual controller of the company is Wang Jianlin. The company has only been established for more than two months. The market once believed that this was Wang Jianlin’s latest business layout.

It is worth noting that just a few days ago, Zhuhai Wanda Commercial Management was once on the hot search, because a large amount of equity was frozen. According to the website of the National Enterprise Credit Information Publicity System, Zhuhai Wanda Commercial Management recently added an equity freezing information, and the amount of frozen equity was about 5.072 billion shares.

At present, Wang Jianlin’s pace of "selling, selling, selling" has not stopped, and even accelerated the pace of sales. In mid-March this year, Wanda Plaza Commercial Co., Ltd. in Jizhou District, Tianjin underwent industrial and commercial changes. The former wholly-owned shareholder Dalian Wanda Commercial Management Group’s joint stock company withdrew, and Beijing Tianding Kunyang Technology Co., Ltd. was added as a wholly-owned shareholder. As of now, Wanda Group has sold 14 Wanda Plaza.

Wang Jianlin suddenly

According to the information disclosed by Tianyancha APP, the joint stock company of Dalian Wanda Commercial Management Group recently added a new equity freeze information.

It is understood that the amount involved in the equity freeze is as high as 16.205 billion yuan, and the company being executed is Dalian Xindameng Commercial Management Co., Ltd.

The term of the equity freeze is from March 20, 2024 to March 19, 2027, and the enforcement court is the People’s Court of Hanjiang District, Yangzhou City, Jiangsu Province.

It is worth mentioning that Dalian Xindameng Business Management Co., Ltd. has only been established for more than two months, and the market once considered this to be Wang Jianlin’s latest business layout.

According to the data, Dalian Xindameng Commercial Management Co., Ltd. was established on January 12, 2024, the legal representative is Xiao Guangrui, the registered capital is 16.20 billion yuan, the company is a business service mainly engaged in the enterprise.

The company’s business scope includes: commercial complex management services; enterprise management consulting; enterprise management; supply chain management services; planning and design management; engineering management services; property management; non-residential real estate leasing; advertising; big data services; energy conservation management services; technical services, technology development, technical consultation, technology exchange, technology transfer, technology promotion; trade brokerage; domestic trade agency; information consulting services (excluding licensing information consulting services); financial consulting; import and export of goods; technology import and export; conference and exhibition services; software development; software sales; data processing and storage support services; Internet of Things technology research and development; Internet of Things technology services; Internet of Things equipment sales; security technology prevention system design and construction services; parking lot services. ( In addition to the projects that are subject to approval according to law, the company shall independently carry out business activities according to law with its business license.)

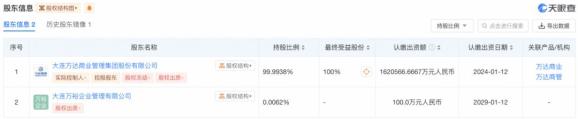

According to Tianyancha APP, the company’s shareholders are Dalian Wanda Business Management Group joint stock company and Dalian Wanyu Enterprise Management Co., Ltd., with shareholding ratios of 99.9938% and 0.0062% respectively.

Among them, the actual controller of the joint stock company of Dalian Wanda Commercial Management Group is Wang Jianlin, and the proportion of beneficial shares is 49.2888%.

Through equity penetration, the actual controller of Dalian Xindameng Commercial Management Co., Ltd., which was frozen by a huge amount, was Wang Jianlin, with 100% of the actual voting rights.

Dalian Wanda Commercial Management was also frozen by a huge amount

It is worth noting that just a few days ago, Zhuhai Wanda Commercial Management was once a hot search, due to the freezing of large shares.

According to the website of the National Enterprise Credit Information Publicity System, Zhuhai Wanda Commercial Management recently added a new equity freezing information, and the amount of frozen equity is about 5.072 billion shares.

The reason for the equity freeze is "property preservation", and the person subject to execution is Dalian Wanda Commercial Management, the major shareholder of Zhuhai Wanda Commercial Management. The enforcement court is the Shanghai No. 1 Intermediate People’s Court, and the freezing period is from March 4, 2024 to March 3, 2027.

Judging from the information disclosed in the enforcement ruling, the trial process of the relevant case may be "property preservation enforcement", but no other details have been released yet about who the specific applicant for enforcement is and what kind of disputes the case involves.

It is worth mentioning that about 5.072 billion shares mentioned above were frozen in July 2023 and thawed shortly after.

It is understood that Zhuhai Wanda Commercial Management was established on March 23, 2021, with a registered capital of about 7.248 billion yuan, and the legal representative is Xiao Guangrui.

From the previously disclosed prospectus, after the introduction of war investment in 2021, 22 institutional investors and 6 executives as cornerstone investors held a total of 21.17% of Zhuhai Wanda Commercial Management. Dalian Wanda Commercial Management directly holds about 69.99% of Zhuhai Wanda Commercial Management, while Wang Jianlin indirectly holds about 8.84% through Zhuhai Wanying and Yinchuan Wanda.

According to this calculation, Dalian Wanda Commercial Management and its concerted actors hold a total of 78.83% of the shares of Zhuhai Wanda Commercial Management, about 5.714 billion shares. At the end of 2023, due to the expiration of the Wanda Commercial Management IPO betting agreement but not yet completed the listing, some strategic investors have changed their shareholdings.

Roughly calculated, the 5.072 billion shares involved in the freeze accounted for 88.8% of the shares held by Dalian Wanda Commercial Management and its concerted actors in Zhuhai Wanda Commercial Management.

In addition, Zhuhai Wanda Commercial Management also involves another 100 million equity freezing information, the executor is also Dalian Wanda Commercial Management, the enforcement court is the Intermediate People’s Court of Dezhou City, Shandong Province, and the freezing time is July 5, 2023 to July 4, 2026.

Wang Jianlin "sell sell sell"

At present, Wang Jianlin’s pace of "selling, selling, selling" has not stopped, and even accelerated the pace of selling.

In mid-March this year, according to Tianyancha, there was an industrial and commercial change in Wanda Plaza Commercial Co., Ltd., Jizhou District, Tianjin. The original wholly-owned shareholder Dalian Wanda Commercial Management Group Joint Stock Company withdrew, and Beijing Tianding Kunyang Technology Co., Ltd. was newly added as a wholly-owned shareholder. At the same time, the company’s registered capital increased from 10 million yuan to 290 million yuan. The legal representative and main personnel also changed. The investor changed from Dalian Wanda Commercial Management Group Joint Stock Company to Beijing Tianding Kunyang Technology Co., Ltd.

According to incomplete statistics, up to now, including Tianjin Jizhou Wanda Plaza, Wanda Group has sold 14 Wanda Plaza. Among them, many Wanda Plaza in Shanghai, Guangzhou and other first-tier cities have been sold.

At present, Wanda commercial management surviving bonds 9, surviving scale 6.902 billion yuan, of which the maturity scale is 1.878 billion yuan within one year; in terms of overseas bonds, Wanda commercial management surviving US dollar bonds 3, surviving balance 1.24 billion US dollars, of which two US dollar bonds will mature within one year, with a maturity scale of 940 million US dollars.

It can be seen that Wanda Commercial Management’s short-term debt repayment pressure is relatively large. At the end of 2023, Wanda Commercial Management’s subsidiary 600 million US dollar debt adjustment repayment plan was approved by bondholders. The maturity date of the bond was adjusted from January 29, 2024 to December 29, 2024, and it was paid off in four installments during the extension period.

In order to deal with the corporate debt crisis, selling assets is undoubtedly the most direct and fastest way for Wanda to withdraw funds.

Selling assets and withdrawing funds has always been a common practice for Wang Jianlin. The last time Wanda Group broke out in a debt crisis, Wang Jianlin was rescued by selling assets.

Original title: "Sudden! Wang Jianlin, big news! Super 16.20 billion is frozen"

Read the original text