[investment points]

(1) The State-owned Assets Supervision and Administration Commission (SASAC) first mentioned "AI empowerment industry rejuvenation". This industrial automation software leader is expected to take the lead in benefiting from the AI+ industry in advance; MES domestic enterprises have the first market share, and hold large-scale PLC products that are scarce in China, so there is a big room for domestic innovation.

② The company is domestic.The first echelon, domestic X86 CPU leader, industryIt is expected to open up the domestic CPU market space, and the DCU business has been harvested.Customers from big factories such as, Ali, etc. are expected to usher in a second growth curve under domestic computing power demand.

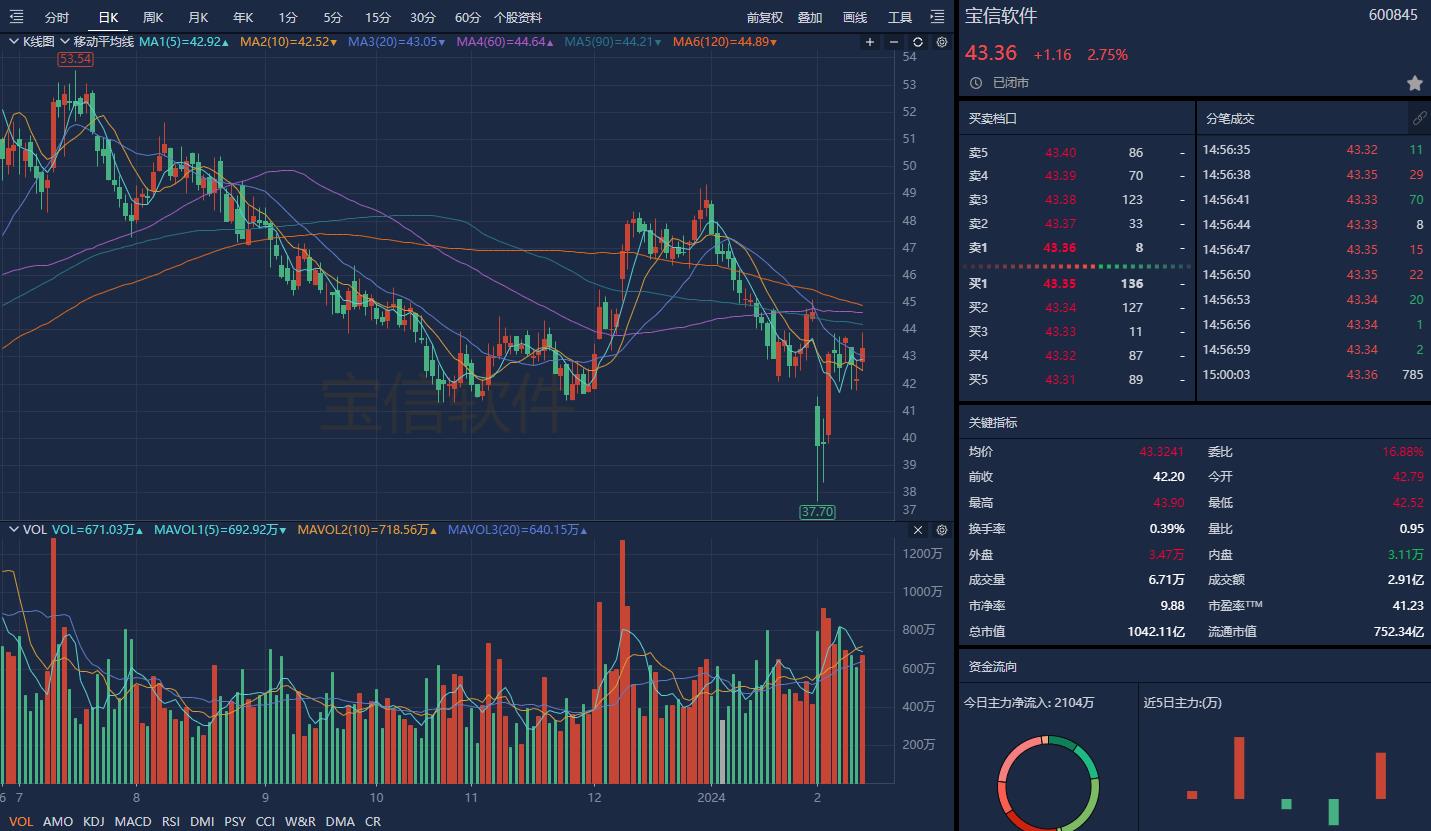

open-sourceRe-covering, maintain the company’s "buy" rating.

February 21, open source release.Re-covering(600845.SH), maintain a "buy" rating. Since the beginning of this year, open source has released the company’s related research reports for three times.、It also covered the stock one after another and gave a "buy" rating.

According to public information, the company started from automation and informatization, and gradually entered the IDC industry, while deepeningNet, AI big model,, AIDC layout; The company is the actual control of China Baowu,The ultimate controller of listed software enterprises controlled by the company is the State-owned Assets Supervision and Administration Commission of the State Council.

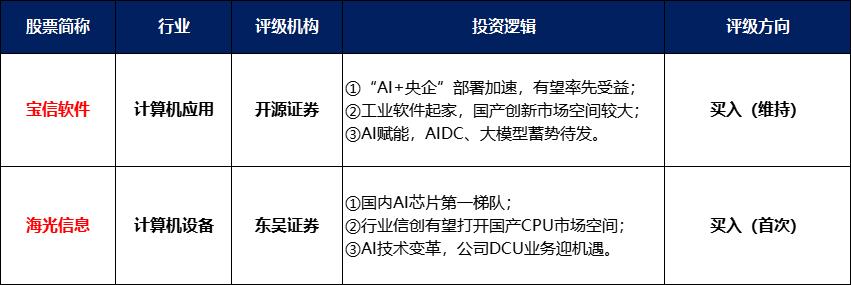

In the secondary market, the company’s share price has been significantly adjusted back in the past year. On February 2, it once hit a new low in the past year. It has rebounded recently and closed on February 22.The company’s share price rose by 2.75%, closed at 43.36 yuan/share.

(Source: Nancai Financial Terminal)

① The deployment of "AI+Central Enterprises" is accelerating, and the company is expected to take the lead in benefiting.

Today, the direction of AI has broken out again, and the concept of "AI+ central enterprises" is hot.

In the news, on February 19,The State-owned Assets Supervision and Administration Commission of the State Council held the central enterprise of "AI Empowering Industry Rejuvenation"Thematic promotion meeting. The meeting stressed that it is necessary to promote the central enterprises to achieve better development and play a greater role in the field; It is necessary to carry out AI+ special actions, strengthen demand traction, accelerate the empowerment of key industries, build a number of multi-modal high-quality data sets of industries, and create a large model to empower the industrial ecology from infrastructure, algorithm tools, intelligent platforms to solutions.

Hua Fu Securities pointed out that,Central enterprises have the advantages of large demand scale, complete industrial facilities and many application scenarios. The entry of central enterprises is conducive to accelerating the improvement of the basic base of China’s AI industry development and promoting the formation of industrial demonstration projects to provide direction for other enterprises’ innovation.

Open source securities said that,As the state supports central enterprises to develop the AI industry, the company is expected to benefit from the core as an industrial software leader+central enterprises. With the deployment of intelligent manufacturing by traditional process enterprises such as iron and steel metallurgy, petrochemical and chemical industry, and the rise of domestic innovation, the company may usher in golden growth opportunities and have great long-term development potential.

(Source: Open Source Securities)

(2) Industrial software started, and there is a large market space for domestic innovation.

In terms of automation, the company is a rare enterprise in China that has launched large-scale PLC (programmable logic controller) automation industrial software products.Open source securities pointed out that before the company launched large-scale PLC products, the market share was monopolized by foreign companies, and domestic enterprises were mostly located in small and medium-sized PLCs. "technical barriers+customer barriers+capital barriers+product exclusivity barriers" and so on have built a high industry barrier for large PLC.

According to the organization, in 2021, the company planned to develop distributed domestic SCADA software for metallurgical industry, and formed a pilot application. At present, the company takes the intelligent control center project of TISCO No.2 Steelmaking Company as an opportunity.The self-development of SCADA, a production control software for process industry, has been realized..

In recent years, the domestic PLC market has maintained a steady growth momentum. Open source securities pointed out that the company’s large PLC is in a period of rapid development with the market share increasing from 0 to 1, and related businesses are expected to benefit from the progress of domestic innovation.

(Source: Open Source Securities)

In terms of informatization, the company relies on Baosteel and Baowu platform, the largest steel group in China, and its industrial software has the first-hand advantage.According to IDC data, the company’s market share in the domestic manufacturing MES (Manufacturing Execution System) software industry was in the top three in the market from 2021 to 2022.The market share ranks first among domestic enterprises., but also at home.MES leading enterprise.

(Source: Open Source Securities)

Open source securities pointed out that MES, as a production information management system, has a short development time. Compared with foreign countries, domestic MES software products still have a certain gap in technical depth and application promotion, and there is still a large domestic space in the future.

③ AI is empowered, AIDC and big model are ready to go.

In recent years, the development of AIGC has brought about a vigorous demand for computing power. China ICT Institute predicts that the global computing power scale will increase by more than 50% in the next five years, which is expected to drive the construction of intelligent computing centers.

According to open source securities, the company has invested heavily in the research and development of AI big model+network platform in recent years:

-

For many years, the company has focused on independent research and development network platforms, such as Baoliandeng xIn3Plat, AI Zhongtai, xAI suite, etc., and actively promoted the research and development of steel AI model, laying the foundation stone for the development of intelligent manufacturing.

-

The company is a first-tier city in China, IDC (Internet) leading, the current IDC supply and demand pattern continues to improve, and the development of AI is in the ascendant.IDC is expected to upgrade to AIDCDavis, who is expected to bring profit+valuation to the company in the future, double-clicks.

predict

Open source securities predicts that the company will realize from 2023 to 2025.Guimu2.586/3.272/4.270 billion yuan,Year-on-year growth of 18.3%/26.5%/30.5%, PE is 39.2/31.0/23.8 times.

(Source: Open Source Securities)

Open-source securities also suggested that the promotion and application of large-scale PLC control systems were lower than expected, industrial development was lower than expected, IDC development was lower than expected and other risk factors.

First coverage, give the company a "buy" rating.

Recently, the research report was released for the first time.(688041.SH), give a "buy" rating.

According to public information, the company is mainly engaged in research and development, design and sales of high-end processors in computing and storage devices such as servers and workstations, and its main products include Sea Light General Processor (CPU) and Sea Light Co-processor (DCU). The company belongs to the state-owned enterprise type and is the first echelon made in China.

Nancai financial terminal shows that it closed on February 22.Closing up 3.85%, reported 82.83 yuan/share. Recently, the company’s share price has risen sharply.Since FebruaryHas risen by nearly 25%.

(Source: Nancai Financial Terminal)

① The first echelon in China

Haiguang Information was authorized by AMD X86 architecture technology in 2016, and on this basis, it realized independent iteration and launched self-developed CPU and DCU products. It is pointed out that the company is the domestic X86 CPU leader, belongs to the first echelon of domestic AI chips, and is one of the few domestic CPU and DCU companies that simultaneously open to the commercial market.

Thanks to strong products, the company’s revenue and net profit increased significantly.From 2018 to 2022, Haiguang’s revenue increased by 106 times. In 2023, the performance continued to increase steadily. According to the company’s 2023 annual performance forecast, it is estimated that the annual revenue will increase by 10.82%-22.14%, and the net profit returned to the mother will increase by 46.85%-64.27%.

② The industry is expected to open up the domestic CPU market space.

According to IDC data, X86 servers account for a high proportion of server shipments because of their most complete architecture ecology. China’s X86 server shipments are expected to continue to increase steadily in the future. It is estimated that by 2025, China’s X86 server chip shipments will reach 10.66 million pieces.

(Source: soochow securities)

The X86 CPU market started late in China, and domestic enterprises have less market share. However, with the arrival of the domestic innovation trend of server bidding, in the future, soochow securities believes that with the increasing proportion of industry innovation, it is expected that the party, government and central state-owned enterprises will realize comprehensive domestic innovation by 2027.The company is expected to open up domestic space through industry innovation, and the demand for servers will increase..

According to the statistics of soochow securities, in 2022, the proportion of domestic server bidding in some central state-owned enterprises will reach more than 30%. In 2023,, operators and other central state-owned enterprises to release pure domestic server bidding. amongHaiguang Information and Huawei are the two major suppliers of Xinchuang servers in the industry..

③ AI technology changes, the company’s DCU business welcomes opportunities.

With the continuous change of AI technology, the market demand for AI chips and computing power has expanded beyond expectations. According to IDC data, it is estimated that the shipment of chips in China will reach 1.335 million pieces in 2023, a year-on-year increase of 22.5%.

The demand for domestic innovation of AI chips is urgent. Since last year, a number of policies have been introduced to support domestic AI chip products.Dongguan Securities is optimistic about Haiguang Information as the first echelon of domestic AI chips, fully benefiting from the acceleration of domestic innovation of AI chips, and DCU business has ushered in a second growth curve.

According to the organization, at present, the company’s Haiguang DCU is based on GPGPU architecture and is compatible with the general "CUDA-like" environment. In terms of performance, the performance of FP64 of Haiguang DCU Shensuan No.1 product can reach.The A100 launched in 2020 and the MI100 launched by AMD in 2020 have improved the performance of the second generation products by 100%, and the third generation products are expected to be launched in 2024. In terms of commercial applications, the company’s DCU products have been certified by Internet companies such as Alibaba and Alibaba, and a joint scheme has been launched.

(Source: soochow securities)

Performance forecast

Soochow securities predicted that the net profit of the company’s homecoming from 2023 to 2025 would be 1.244/1.749/2.379 billion yuan respectively, up by 54.77%/40.64%/36.00% year-on-year.

(Source: soochow securities)

Soochow securities also pointed out the risk factors such as policy support, technology research and development, and AI development.

(The content of this article comes from licensed securities institutions, and does not constitute any investment advice, nor does it represent the platform’s point of view. Investors are requested to make independent judgments and decisions. )