The three major A-share indexes collectively pulled back today. As of the close, the Shanghai Composite Index fell 0.42% to close at 3,157.97 points. The Shenzhen Component Index fell 0.71% to close at 9681.66 points; The growth enterprise market index fell 0.77% to close at 1861.48 points. The turnover of Shanghai and Shenzhen stock markets was only 799.3 billion yuan, a decrease of 196.1 billion compared with the previous trading day.

Most of the industry sectors closed down.、、、The plate was among the top gainers.、、、、、The plate was among the top losers.

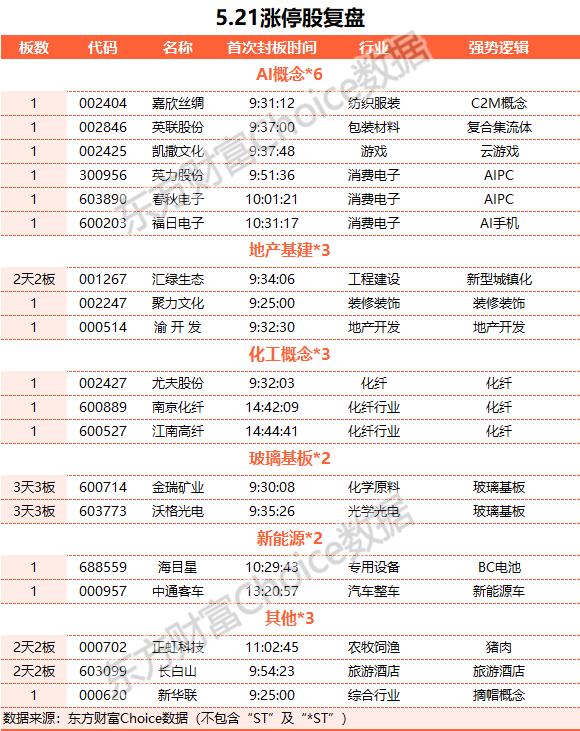

In terms of individual stocks,The number of falling stocks exceeded 4,000.Glass substrate concept stocks are active again,、、Daily limit Copper foil concept stocks rose sharply at the opening.Daily limit AI PC concept stocks fluctuated and rebounded.、Daily limit Pork stocks rose in intraday trading,2 connecting plates. The stock changed in the afternoon,Daily limit,Up more than 5%. In terms of decline, gold and non-ferrous concept stocks were collectively adjusted.Wait for many stocks to fall more than 5%.

The net outflow of northbound funds was 1.967 billion yuan.

Northbound funds sold 1.967 billion yuan today, ending three consecutive days of net purchases; The turnover in the whole day was 103.558 billion yuan, accounting for 12.96% of the total turnover of A shares.、、The net sales were 215 million yuan, 195 million yuan and 117 million yuan respectively.The net purchase amount ranked first, amounting to 549 million yuan.

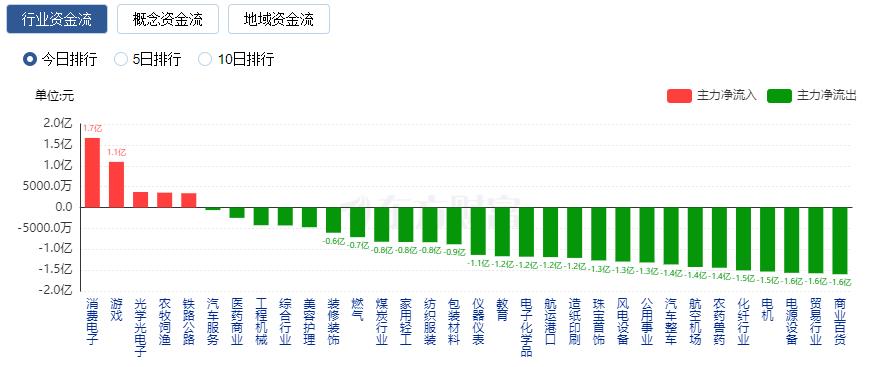

Industry capital flow: 167 million net inflow

In terms of industry funds, as of the close,,,The net inflow ranked first, including the net inflow of consumer electronics of 167 million.

In terms of net outflow,、And other net outflows ranked first, with a net outflow of 2.081 billion yuan.

Today’s news

National Development and Reform Commission: Expand the consumption of automobiles, home appliances, mobile phones and other goods and services such as cultural tourism.

The National Development and Reform Commission held a press conference in May. The spokesman said that in promoting domestic consumption, the National Development and Reform Commission will speed up the implementation of the employment priority policy and do everything possible to stabilize employment, increase income and improve residents’ spending power. Accelerate the trade-in of consumer goods, expand the consumption of automobiles, home appliances, mobile phones and other commodities and services such as cultural tourism, and intensify efforts to cultivate new growth points such as creating new consumption scenarios and new formats.

AI PC comprehensive "bright sword" domestic sales of 8688 yuan! Microsoft launches Copilot, fully integrated into Windows 11.

A new Surface computer will be launched, following its Copilot+ standard to run.Model; These computers and other computers use arm-basedChip to provide a longerLife span, equipped with AMD andChip computers will also be available; The new function Recall helps to find what you have seen on your PC and provides real-time subtitles translated in more than 40 languages, including Chinese. The new Copilot+Surface Pro starts at $999 and starts at 8688 yuan in China.

The first city of low-altitude economy is competing for speed-up: what are all localities fighting for? Who will stand out?

Since the beginning of this year, more than ten provinces and cities, including Beijing, Nanjing, Anhui, Shenzhen, Suzhou, Shenyang, Taicang, Wuhan, Tianjin, Shandong, Changsha, Zhangzhou, etc.Relevant action plan or relevant draft for comments. Including Chongqing, Anhui, Jiangxi Gongqingcheng, Suzhou, Guangzhou, Wuhan, Guizhou and many other provinces and cities, have successively launched industrial funds to stimulate industrial development, of which the largest scale is 20 billion yuan.

Repurchase+cancellation of 180 billion "milk Mao" is great! Top 20 buybacks released during the year.

On the evening of May 20th,The 2023 Annual General Meeting of Shareholders was held, and the Proposal on the Scheme of Repurchase of the Company’s Shares by Centralized Bidding was reviewed and approved. The company intends to buy back shares by centralized bidding, and the amount of repurchase is not less than 1 billion yuan and not more than 2 billion yuan; The repurchase price does not exceed 41.88 yuan/share. All the repurchased shares will be cancelled according to law and the registered capital of the company will be reduced. After the cancellation of restricted stock repurchase, the registered capital of the company decreased from 6,366.09 million yuan to 6,365.96 million yuan. At the same time, 12 yuan will be distributed to all shareholders for every 10 shares (including tax), with a total cash dividend of 7.639 billion yuan, an increase of 1.018 billion yuan over the previous year, accounting for 73.25% of the company’s net profit in 2023. On the evening of May 20th, in addition to the announcement of share repurchase,、、Repurchase plans have been issued one after another, and the purpose of repurchase is almost to reduce the registered capital of the company.

Four departments jointly issued a document! Deepen the development of smart cities and develop emerging digital industries according to local conditions.

On May 20, the National Development and Reform Commission and other four departments issued "On DeepeningGuiding Opinions on Developing and Promoting Urban Digital Transformation, 13 specific measures are put forward from five aspects: promoting urban digital transformation in all fields, strengthening urban digital transformation support in all directions, and optimizing urban digital transformation ecology in the whole process. Judging from the overall requirements, the Guiding Opinions put forward that by 2027, the digital transformation of cities across the country has achieved remarkable results, forming a number of livable, resilient, and strong support for the construction of digital China. By 2030, there will be a comprehensive breakthrough in the digital transformation of cities across the country, and a number of Chinese-style modern cities with global competitiveness will emerge in the digital civilization era.

Institutional point of view

: look goodInvestment opportunities in the plate

It is pointed out that compared with 2015, today’s real estate policy is different in objectives, means and impact on fundamentals. The real estate policy in 2024 is based on the background of great changes in the relationship between supply and demand of real estate, and it is based on the real demand for affordable housing, with more emphasis on the policy of the city. In addition, the policy attaches importance to avoiding the surge in supply while restoring the hematopoietic function of enterprises. Since this policy is driven by the real demand for commercial housing and affordable housing, and it is expected to be carried out on a large scale mainly in first-and second-tier cities with solid demand, it will take a long time to judge that the housing price has stopped falling and the possibility of an overall increase in core cities after it has stopped falling is very low. Generally speaking, at this stage, the business is more focused on the core cities, the financing channels are smooth, the product capabilities are strong, the local interaction ability is strong, and companies with some high-quality assets are more valuable for investment. Optimistic about investment opportunities in the sector.

: continue to be optimistic about the sustained recovery trend of consumption in the second half of the year.

It is pointed out that in April, the social security increased by 2.3% year-on-year, and the slowdown in growth rate was mainly due to the reduction of holiday days and the high base. The toughness of compulsory consumer goods is still strong, and the performance of optional consumer goods is differentiated. The post-cycle consumption of real estate in 2024M4 shows differentiation, and it is expected that the consumption of household appliances will further pick up after the policy is launched. Continue to be optimistic about the sustained recovery trend of consumption in the second half of the year, pay attention to the subsequent CPI and consumer confidence performance, and suggest paying attention to the leading consumer goods with brand, product, channel and management advantages.

: give priority to stability, and accept it when it is good.

The real estate purchasing and storage policy landed, and the down payment and interest rate reduction exceeded expectations, which was beneficial to just need. The bond market reacted calmly, and the stock market first responded to optimistic expectations. Recently, domestic production has been repaired, but domestic demand is generally weak. There are uncertainties in Sino-US relations in the election year of the United States, and the relationship between supply and demand in the A-share market has changed marginally recently. On the whole, we think that we can still be optimistic about A-shares strategically, but we should not be too radical tactically in the short term. We should focus on stability, and we can take the attitude of "taking what is good" in trading. Structurally, we will continue to pay attention to the improvement of export orders and the incremental effect of going to sea, such as, leading household appliances, etc. Pay attention to dividends, colors, etc. on dips.

: Pay attention to the high ROE and high FCF faucet.

Since the beginning of this year, the rotation speed of the industry and the main line has obviously accelerated, and the range of excess returns of the industry and the main line has obviously narrowed. It is related to the current lack of high prosperity direction, increased policy strength and efficiency, investor sentiment and risk preference, and the capital environment of stock game. However, there is a hidden line behind the rotation of the main line of the industry that the excess returns are steadily increasing. The high ROE and high FCF leader can become a stable and dominant style strategy under the background of stable economic profit, accelerated improvement of free cash flow of enterprises and intensified asset shortage.