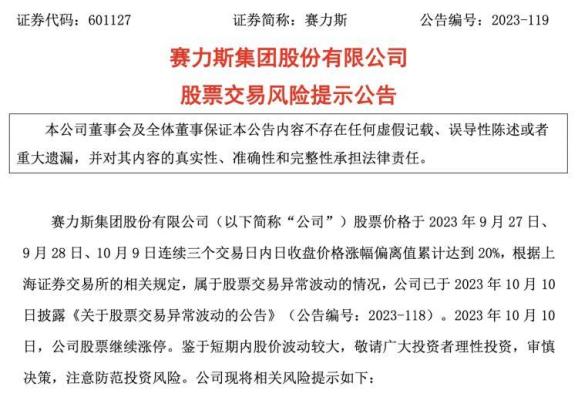

Sanlian Sailis (601127) issued a stock trading risk warning announcement on the evening of October 10. Since August 28, 2023, the company’s stock has risen by 110.42%, the Shenwan Auto Index has risen by 7.28% over the same period, and the Shanghai Composite Index has risen by 0.36% over the same period. The company’s stock short-term increase is higher than that of the industry and the Shanghai Composite Index over the same period, and there is a risk of overheating market sentiment.

Among them, the company’s stock price rose by the limit for three consecutive trading days from September 28, 2023 to October 10, 2023, but the company’s fundamentals have not changed significantly, and there is no major information that should be disclosed. As of the close on October 10, Sailis closed at 67.42 yuan/share, with a total market value of 101.60 billion yuan.

In the announcement, Sailis pointed out the risk of performance fluctuations. In the half year of 2023, the company realized operating income of 11.032 billion yuan, a decrease of 11.14% over the same period of the previous year, and realized net profit attributable to shareholders of listed companies – 1.344 billion yuan. From January to September 2023, the company sold a total of 136,786 vehicles, a year-on-year decrease of 30.65%, of which 68,223 new energy vehicles were sold, a year-on-year decrease of 25.16%.

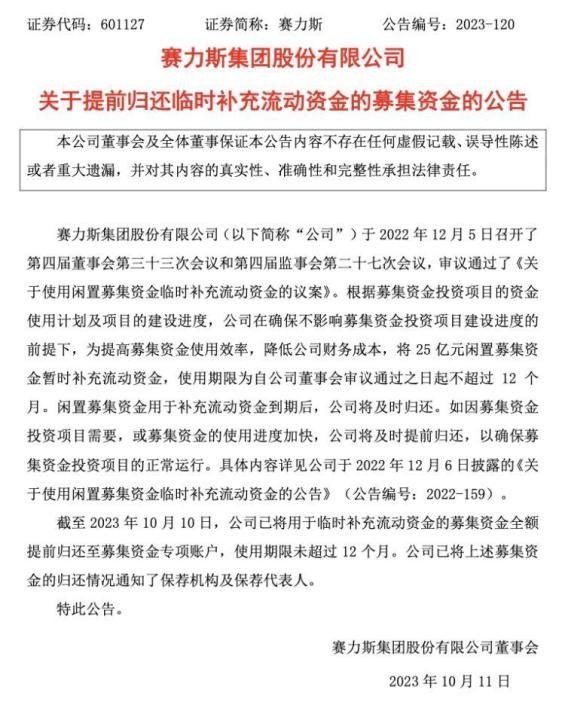

On the evening of the same day, Sailis issued an announcement on the early return of the proceeds raised by the temporary supplementary working capital.

According to the announcement, the company held the 33rd meeting of the 4th board of directors and the 27th meeting of the 4th board of supervisors on December 5, 2022, and considered and passed the "Proposal on the use of idle proceeds raised temporary supplementary working capital".

According to the capital use plan of the proceeds raised investment project and the construction progress of the project, the company will temporarily supplement the working capital of 2.50 billion yuan of idle proceeds raised in order to improve the efficiency of the use of proceeds raised and reduce the cost of company financing, and the use period shall not exceed 12 months from the date of consideration and approval by the board of directors of the company. After the idle proceeds raised is used to supplement the working capital expires, the company will return it in time. If the use progress of proceeds raised investment projects is required or the use progress of proceeds raised is accelerated, the company will return it in advance in time to ensure the normal operation of the proceeds raised investment project.

As of October 10, 2023, the company has returned the full amount of proceeds raised for temporary supplementary liquidity to the proceeds raised special project account in advance, and the use period has not exceeded 12 months. The company has notified the sponsor and the sponsor representative of the return of the above proceeds raised.

On the evening of October 9, Sailis announced that the stock transaction was abnormal, saying that after self-examination, the company’s current production and operation activities are normal and no major changes have occurred. AITO asked the new M7 was listed and delivered, which aroused attention and heated discussions. In addition, the company did not find media reports or market rumors that may have a significant impact on the company’s stock trading price.

Source: Read and create/Shenzhen Business Daily Comprehensive

Original title: "Triple Board!" Huawei Auto Concept Stock "Cyrus: Risk of Overheating Market Sentiment"

Read the original text